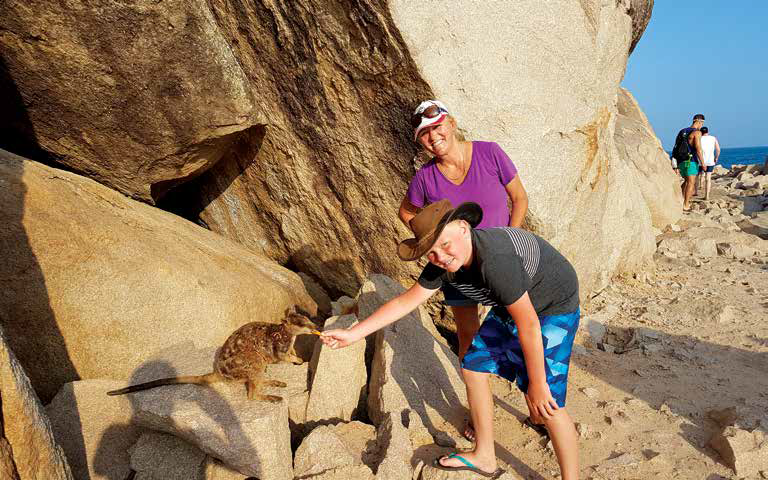

The Hunter family

Living on the road and travelling around Australia is a great dream. Imagine swapping your cares about work and commitments for the open road, a map and a sense of adventure.

It’s not a lifestyle to suit everyone, but increasing numbers of Australians are embracing flexible working conditions, the freelance economy is booming and the advent of platforms such as Airbnb allow for homes to be leased on short and long-term conditions.

Aside from work and family obligations, the big question for anyone considering a long-term adventure is how can it be funded.

Retirees commonly take advantage of access to their superannuation to buy a rig and tow tug and head off into the sunset, but families are also adopting the nomadic lifestyle by selling or renting their homes, working as they go and schooling kids on the way.

Here, we chat with the Hunter family who are living on the road full-time, and a couple who are in the midst of a six-month trip to get their top tips on setting budgets from the outset, making plans to be self-sufficient and how to not blow a massive hole in your wallet while on the road.

Magnetic Island

THE HUNTER FAMILY

Jo and Evan Hunter and their 12-year-old son Cooper have been travelling in their second-hand 21ft 6in Nova Family Escape van since 2017. Evan was offered a redundancy package from BlueScope Steel in Wollongong, NSW, and the pair decided to bring forward their idea of travelling around Australia. They had decided to wait until Cooper had finished school but, as their four adult children had moved out of their seven-bedroom home, it seemed like the universe was telling them to sell the house and go on an adventure.

Jo found a buyer for her hairdressing salon and they set about selling everything they wouldn’t need — cars, the family boat, furniture, personal belongings, toys and scores of household items that wouldn’t fit into the van.

“We sold a lot of stuff,” says Jo. “We don’t miss it. You actually realise how much junk in a sense you gather. You don’t need all that stuff. Especially not for the experiences we are having along the way and people we are meeting.”

WORKING ON THE ROAD

Jo and Evan set aside a lump sum of $30,000 to travel indefinitely. They have a buffer with their house profits but are topping up their bank balance by working around the country. They do this to avoid draining their savings, which they may use down the track to buy another home, but also to broaden their skills, meet new people and have unique experiences as a family.

So far they have worked on a farm in Bald Hills, QLD, then in the sugar cane industry further north in Tully. They headed to South Australia with a stop in Clare Valley to work on a sheep station with Evan undertaking general farm duties and then up to Yarri Station in the heart of WA’s Pilbara where they spent time mustering. The family stayed in Perth for five months and then headed south to Adelaide for their daughter’s wedding before travelling north again to the NT and Queensland.

Evan is a very handy guy and already had a vast skillset, but he can now add station mechanic, musterer and road train driver to his resume. Jo has also fully embraced the opportunity to learn how to change truck tyres, shear sheep, cook daily lunches for 15 to 20 hungry cattle musterers and spend up to 10 hours on the road shopping in bulk at the nearest shopping centre hundreds of kilometres away.

“It is so easy getting work,” says Jo. “We have had no problem, whether it is word of mouth or referral. I am a hairdresser by trade but I have cleaned motel rooms — it doesn’t bother me. It’s great! I got that off Gumtree. I handed out resumes when we got to Kerry Creek and I was inundated with phone calls.”

The pair recently did some voluntary work in a van park in exchange for their site fees.

Yarrie Station (sign was supporting charity for depression)

A WEEKLY BUDGET

Evan said they worked out a weekly budget to be able to afford their campsite fees (although they have begun to free camp more often), food, sightseeing and petrol.

“Our research showed that we had to allow between $500 and $1,500 a week, and we worked out we were at $1,000 a week which is probably a bit lavish when you add it up over a year — it is not cheap,” he says.

“We do want to enjoy ourselves and we have done some touristy things like paid to go bareback horseriding at Magnetic Island and diving the Great Barrier Reef and those are once in a lifetime experiences but you can’t keep doing that. We don’t have a pencil and paper keeping records of our budget, we are fortunate to not have to really worry about that.”

The family have now reduced costs to around $600 a week and have also cut back on paying for tourist attractions.

“We also don’t really do any paid touristy things anymore as there is so much to see and do that is free in this gorgeous country of ours,” says Jo.

Fuel is the family’s biggest expense, and they carry four 20L jerry cans and fill them up in towns when prices are reasonable.

Time for a soak with a sundowner at Julia Creek Caravan Park

FEEDING THE FAMILY

When it comes to food, Jo says she has learnt to not over-buy on items, particularly perishable ones, which was tricky in the beginning after being so used to feeding a large family. She has dietary issues so makes sure she buys what she needs at cheaper prices where she can, although in more isolated parts of Australia you will always have to pay a premium for food, fuel and necessities.

“We save money by almost never eating out or buying snacks, at service stations especially,” she says. “I buy things like frozen pies/sausage rolls from supermarkets and we have a small 12V oven (best buy ever) in the car to heat them up, and I also make extra dinners some nights and freeze them to be reheated for lunches.

“We also love fishing so try to catch our meals whenever possible as well as crabbing.”

NO REGRETS

The family understand they have probably sacrificed a more secure financial future by selling their home and not contributing to their super as they would have with jobs, but they say money can’t buy their experiences.

“I did a rough calculation of where we would be in 20 years if we had stayed and paid off our mortgage,” says Evan. “We would have retired with more than a million in super, we would have had our house and another investment property … but I don’t really care. This is priceless.

“Now I class myself as semi-retired. I think families should just do it!”

Jo says they are currently making their way back towards the east coast to be closer to family, and find somewhere to base themselves for five to six years so Cooper can attend high school.

“We are hoping to either manage a caravan park or a farm during these years and save as much as possible to travel and work again when Cooper finishes high school — we just absolutely love this lifestyle!”

Cycling out to Mary Kathleen uranium mining town site

THE HUNTERS’ TOP BUDGETING TIPS

• Shop in bulk in main towns

• Avoid servo snacks

• Set a weekly budget

• Carry jerry cans for cheap fuel

• Work on the road to top up.

SUE MCGILVRAY AND MICHELLE SMITH

Sue McGilvray and Michelle Smith, a couple from the NSW South Coast seaside haven of Gerringong, are in the midst of a six-month adventure to Far North Queensland. It had always been their plan to do a ‘Big Lap’ of Australia with their 5.8m (19ft) New Age Big Red towed by their Jeep Grand Cherokee, but the opportunity to go a few years earlier than expected came up when friends were looking to rent a house in the area.

Sue and Michelle packed up their belongings and stored them in the bottom level of their two-storey home, and organised a 12-month lease. The pair also have two cats, one of which is in the care of their tenants and the other is with family friends.

They spent the first six months staying with relatives and doing short trips while Sue, who teaches swimming classes to kids across the southern NSW region, finished her term one lessons. Then they headed north toward Cape York.

Sue says the rental opportunity was fortuitous timing. It made sense financially to have income from their home but also peace of mind that their house and pets were being well cared for.

“I couldn’t have done that by putting it out in the paper and saying ‘who wants to lease the house’,” she says. “It was always going to have to be somebody that we knew and trusted, so that worked out really well.”

Sue and Michelle lease the bottom level of their home on Airbnb as Sea Mist, but have put that on hold while they travel. The income they are receiving from rent was factored into their touring budget.

SETTING A BUDGET

The couple set up a separate account for caravan park accommodation and fuel before they left. Because they are in the middle of ‘grey nomad’ season, the parks along the coast have been booked out, so Sue has been reserving sites in advance and they have not yet done a lot of free camping. Michelle thought it would cost around $5,000 for every 10,000km they travelled, but they say that expenses have blown out more than anticipated.

“It became evident in the first month that what we were doing was a lot more expensive than what we thought it was going to be,” Sue says. “So we have had to dig in to savings heavily.

“The reason we are happy to do this, is that we won’t come back to Far North Queensland — this is a one-off. So things we are doing in Cooktown and Longreach like the sunset cruises, the Lava Caves tour, the Stockman’s Hall of Fame, a guided 14km walk in Carnarvon Gorge and the Dinosaur Museum in Winton are things that we won’t do again.”

The couple know their holiday has a limited lifespan (they will be back in October) and they will resume their Airbnb bookings and Sue will go back to teaching.

Catch of the Day

ON-ROAD SAVING

Fuel and food are major expenses along with touristy attractions, but the pair have found some ways to save money.

Like the Hunter family, they bulk buy groceries and water in major towns and head to alcohol super centres such as Dan Murphy’s to stock up on necessities for the all-important happy hour. Michelle says some sacrifices have had to be made…

“We are not drinking bottled wine, we are drinking cask wine,” says Michelle. “So we have had to lower our standards quite a bit!”

The pair do occasionally splurge on a pub lunch while on the road but preparing their own meals instead of eating out every night also saves them money. It’s something they love for the social aspect, too.

“We prefer to barbecue and when you go to the camp kitchen you meet these really amazing people and as you are chopping and preparing you are chatting with them, and hearing their stories and getting their travel tips,” says Sue.

One of the main ways they have saved on dosh is avoiding takeaway coffees.

“We bought a reasonably cheap coffee machine because coffee was costing us $11 a day, so we bought a little pod machine and that has been really good,” says Michelle. “They had a bonus offer of 100 free pods so we got 120 coffees free for the price of the machine.”

Sue and Michelle visiting the stockman show at Longreach, QLD

HAVE A BUDGET BACK-UP

The couple say they have learned a lot about budgeting while on the road, especially about how to manage the things you can’t plan for. Part of the car “fell apart” while on the way to Cape York, which was an unexpected (and also unpleasant) surprise. “We didn’t realise how tough the roads would be on the vehicle up there,” says Michelle. “We spent about $3,000 on car service and repairs — but then it is a Jeep.”

Understanding how your van works and being able to fix things yourself, where possible, will also save time as well as money.

“Unexpected things just go wrong,” says Michelle. “I just spent three hours this morning fixing the toilet!”

They won’t stop long enough to work en route on this trip, but would do so if they were on the road for longer periods of time. Overall, the pair reckon setting budgets is a great idea, but having a savings backup and a financial plan post-trip is the best way to go — stressing about it while you are on the road is simply not worth it.

“If you are going to go away from a long trip and you are going to sweat about the dollars that you are going to spend, well, don’t do it,” advises Sue.

“Because things could happen in the Middle East with petrol supplies and the price could skyrocket and there goes whatever budget you thought you had. Just plan to set off with a really positive attitude and enjoy this country.”

Evan shearing sheep

Category: Features

Written: Fri 01 Nov 2019

Printed: November, 2019

Published By:

Supplied